Blog

Understanding the consequences and financial impact of patients without medical coverage to your healthcare organization

Healthcare providers need to focus on patient eligibility and enrollment with a comprehensive, holistic approach centered on patient advocacy.

By Kemberton | October 1 2021

Health insurance claims and explanation of benefits continue to be overly complicated, which can lead to confusing bills and ultimately uncompensated care as uninsured and underinsured patients may not be able to afford the coverage they need for medical care. 9.2% of the U.S. population was uninsured in 2019, rapidly climbing to over 12% in the first half of 2020. This number is likely even higher today, with up to 27 million households losing healthcare coverage in the wake of record job losses due to the Covid-19 pandemic.

A 2020 Commonwealth Fund survey found that more than 43% of working-age adults had inadequate health insurance when the COVID-19 pandemic hit. Half of the uninsured or underinsured adults reported having problems paying medical bills or are in medical debt.

Who is Underinsured?

More than two in five adults ages 19 – 64 are inadequately insured based on the following criteria:

- Their reported out-of-pocket costs, excluding premiums, over 12 months are equal to 10% or more of household income

- Their reported out-of-pocket costs, excluding premiums, over 12 months are equal to 5% or more of household income for individuals living under 200% of the federal poverty level, or

- Their deductible constitutes 5% or more of household income.

Source: The Commonwealth Fund. U.S. Health Coverage in 2020

The underinsured patient population is a growing trend with a staggering 43% increase of enrollment in high deductible health plans (HDHPs) since 2014. The latest available data in 2019 reveals that 51% of the nation’s workforce was enrolled in a HDHP, the highest percentage over the past five years.

The IRS defines a HDHP as one with a deductible of at least $1,400 for an individual or $2,800 for a family. While individuals with HDHPs pay lower monthly insurance premiums, they end up paying more out of pocket for medical expenses until their deductible is met. The primary adverse scenario with HDHPs is being hit with a massive medical bill. For example, patients may get a routine checkup that is covered by insurance and then find out they have a serious — and expensive — health problem that won’t be covered.

Many employers opt for HDHPs as the sole health insurance offered to employees, assuming they’ll use their health care benefits selectively and avoid unnecessary procedures and medications. While it makes financial sense from the employer’s point of view, the fact is most people don’t have the medical expertise to distinguish between high-value and low-value care.

High-deductible policies have annual premiums that are on average 36% cheaper than low-deductible policies, but can have adverse effects as patients have higher out-of-pocket costs.

Uninsured and underinsured patients are less likely to receive high-quality care, and their chronic conditions do not get properly managed. They are more than twice as likely to report forgoing necessary care because of costs, leading to chronic health issues that then require more expensive treatments further down the line.

Uninsured patients also use emergency rooms and inpatient hospital care at double the rate of those who are continuously insured, leading to an over-utilization of the emergency department, which is known in health circles as the “front door to bad debt.”

Though the uninsured and underinsured are billed for medical services they receive, the costs likely become bad debt or uncompensated care for providers when patients cannot afford to pay costly bills.

In 2019 alone, over 5,000 of the nation’s hospitals incurred $41.61 billion in uncompensated care costs.

According to the American Hospital Association, hospitals have provided more than $660 billion worth of uncompensated care since 2000, with each newly uninsured individual associated with a $900 increase in uncompensated care annually. When uninsured patients receive care, health systems often bear the cost.

However, with the expansion of coverage under the Affordable Care Act, providers are seeing reductions in uncompensated care costs — which has become a helpful aid for people who have lost employer insurance. But therein lies another challenge: uninsured patients who qualify for Medicaid often have limited knowledge of enrolling for coverage. In a recent survey, 40% of patients said they would not have found coverage without help, while 12% of patients — nearly five million people — tried to find help for enrollment but did not get it.

How a patient-centric approach addresses eligibility and enrollment challenges

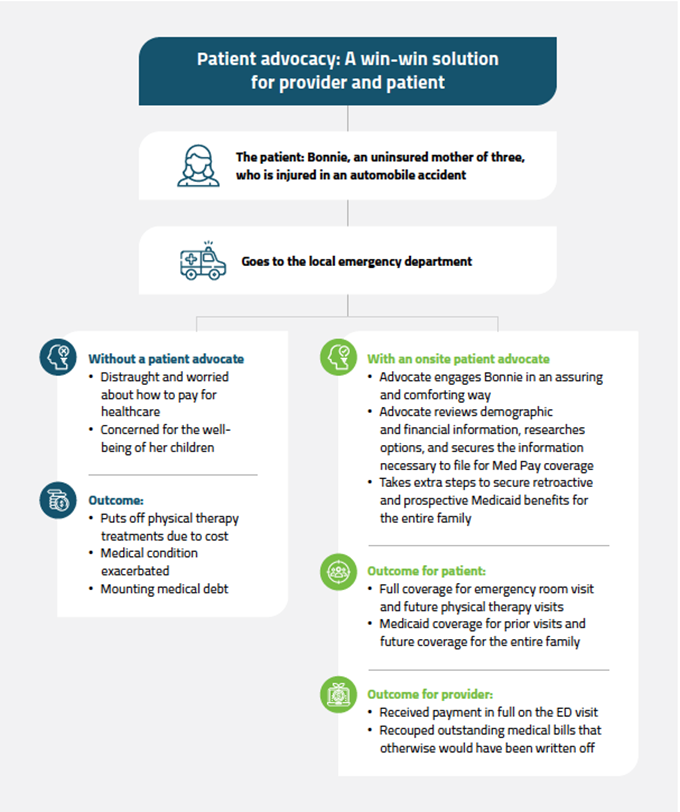

The solution may be deceptively simple: a patient-centric approach centered on advocacy that not only improves patient engagement, but also reduces healthcare costs, lead to better financial outcomes for both providers and patients.

By utilizing on-site patient advocates, healthcare providers can help a significant portion of patients find and secure suitable coverage to maximize reimbursement and reduce bad debt. This holistic approach focuses on the whole patient — from the first encounter through to release.

Whether your organization provides these services internally or outsources to a specialized RCM partner like Kemberton, these highly trained patient advocates have the skills and expertise required to help patients navigate complex applications through various health coverage programs — including Medicaid, Children’s Health Insurance Program (CHIP), Social Security Administration Benefits (SSI, SSDI), and many more available plans.

Having a holistic approach in managing the uninsured and underinsured patient population leads to better health and better financial outcomes for patients and providers, including:

- Reduced length of stay

- Reduced readmission rates

- Reduced bad debt

- Reduced out-of-pocket costs

- Maximized reimbursement for services

- Enhanced Patient Experience

How Kemberton can help

When you engage Kemberton’s Disability Eligibility and Enrollment Services, our team of dedicated patient advocates guide patients through the complex application process to identify all available financial resources and coverage options for every unique patient need. In doing so, we ensure not only optimal revenue recovery for your health system, but also continuity of service for uninsured and underinsured patients.