Blog

As the number of Veterans utilizing VA health benefits increases over the next five years – learn how a specialized revenue cycle partner can maximize reimbursement

With the highly complex nature of Veterans Administration claims, working with a specialized revenue cycle partner for VA claims processing is a much more efficient and cost-effective option for providers.

By Kemberton | November 8 2021

Rising traffic of VA patients at non-VA health facilities

As the largest integrated healthcare system in the U.S., the Veterans Health Administration runs over 1,200 Healthcare Facilities, but these facilities alone cannot adequately meet the needs of over 9 million Veterans enrolled in the VA healthcare program. Over the past several years, more non-VA healthcare providers are treating a higher traffic of VA patients. However, the highly complex nature of VA claims makes getting reimbursed for care a unique challenge for providers.

Up to 60% of VA enrollees seek concurrent primary care at non-VA healthcare facilities, especially in rural areas where the nearest VA facility may not be easily accessible. Studies by RAND have found that VA patients get more than half of their care through non-VA sources, especially for prescription drugs and inpatient visits associated with surgery.

Exactly how many VA patients come through your health system depends on the unique environment, location, and population mix of your organization, but the general consensus is that the number of Veterans who rely on VA health benefits is expected to increase over the next five years before levelling off. Data from the Census Bureau also projects the changing demographic distribution of Veterans in the near future: more Veterans concentrated in urban areas, more women, and younger patients overall.

Recent legislative changes have also made it easier for Veterans to obtain care at non-VA facilities. The Maintaining Internal Systems and Strengthening Integrated Outside Networks (MISSION) Act of 2018, intended to give Veterans access to healthcare when and where they need it, has led to higher VA traffic at non-VA facilities. Meanwhile, a landmark Court of Appeals ruling in 2019 paved the way for non-VA healthcare providers to be reimbursed for up to $6.5 billion in emergency care services delivered between 2016 and 2025.

VA claims: A tedious, time-consuming process

With all these factors, healthcare providers must be acutely aware of how to treat VA claims or risk higher proportions of aged A/R and millions of dollars in underpayments — if claims are even successfully resolved at all. While most healthcare providers’ patient financial services and revenue cycle teams are equipped to collect reimbursement from traditional health payers more efficiently, VA claims can be an entirely different ball game altogether — overly complex, extremely time and resource consuming, and requires highly specialized expertise.

Rather than develop the necessary training and expertise in-house, healthcare providers may find outsourcing VA claims to be a far more efficient and cost-effective option that enables them to reallocate time and resources toward more viable claims. Some of the reasons to consider working with a specialized revenue cycle partner for VA claims are:

1. Identify appropriate payers and ensure timely filing

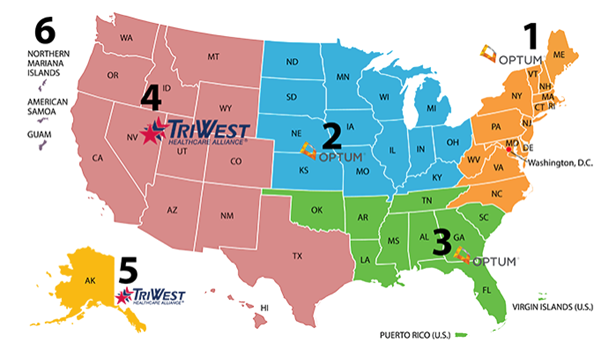

The most important step of getting claims properly reimbursed is complying with the VA’s stringent filing requirements. Depending on your healthcare organization’s status in the VA’s network and how the care was authorized, claims must be filed with the correct third-party administrator. As of March 31, 2021, the VA has transitioned from Patient Centered-Community Care (PC3) to Community Care Network (CCN) with an established transition period for care through PC3 within Regions 5 (Alaska) and 6 (Pacific Islands) through March 31, 2022.

For authorized care in Regions 1-3, providers that are enrolled in CCN need to go through Optum United Health Care, while Regions 4-5 providers should file claims with TriWest Healthcare Alliance for both CCN authorized care and transitory PC3 claims. If your organization has a Veterans Care Agreement (VCA) or are not part of one of VA’s formal networks, claims should be filed directly with the VA.

The deadlines for filing claims are as follows:

| Program | Filing Deadline |

| Authorized Care | 180 days |

| Unauthorized Emergent Care (service-connected) | 2 years |

| Unauthorized Emergent Care (not service-connected) | 90 days |

2. Minimize rejected and denied claims

Unlike other payers, VA regulations differentiate denied and rejected claims, although lack of visibility into the claim status can be a source of impediment for healthcare providers. “Denied” claims declare there is no basis for payment, while “rejected” claims cannot be decided until the additional or corrected information is provided. In either case, intervention is required and more often, appeals become the norm. Unaddressed denied and rejected claims shift the financial burden of care to the Veteran, which then presents a significant financial risk to providers as these medical bills mount and end up as bad debt.

Avoidable errors — even those as small as an additional space or punctuation in the patient’s ID number — can cause a claim to be rejected. According to the VA, these are the top reasons claims are rejected:

- Missing/Incomplete/Invalid Insured ID

- Outpatient Claim has a Missing “Admission Type” Code

- Missing Admission Type when Admission Date is Present

- Referring and Attending Physician NPI are Equal

- Claim Contains a Missing/Incomplete/Invalid Billing Provider Address

Adding to providers’ long list of challenges in processing VA claims, the VA does not provide a traditional route to appeal denied claims. This highlights the importance of filing claims on time and correctly the first time, every time — and the necessity of assigning specialized resources with the necessary experience and expertise to navigate all the piles of paperwork associated with VA claims.

3. Navigate the complex challenges of all VA programs

In the traditional revenue cycle, health insurance claims ideally can be recovered in no more than one or two touchpoints. VA reimbursement, on the other hand, requires extraordinary effort and multiple touchpoints. Successfully adjudicating VA claims depends on persistent and knowledgeable follow-up. Although the VA stipulates that claims will be processed within 30 to 45 calendar days, providers can spend up to a year or more waiting on unpaid claims, leading to aged A/R and a much lower likelihood of collection.

In addition, many providers don’t have the time or resources to follow-up on each VA claim — a tedious, time-consuming task — in an efficient manner. For example, phone access hours are limited, and VA call center staff adhere strictly to the number of claims that can be discussed for each call. Instead of spending hours to follow-up on one VA claim, which leads to overwhelmed staff and higher costs to collect, working with a specialized VA claims partner enables your revenue cycle team to refocus their time and efforts on higher and more viable reimbursing payers.

4. Enhance the patient experience

Finally, one of the biggest advantages of outsourcing your VA claims is an improved experience for Veteran patients. Instead of an overwhelming maze of red tape, patients are guided with personalized advocacy and compassion by experienced VA specialists through every step of their healthcare journey — which greatly increases engagement, enhances the patient experience, and reduces anxiety due to the uncertainty of potential medical costs.

How Kemberton can help

When you partner with Kemberton for your Veterans Administration Claims, you gain access to VA collections specialists and experienced Veteran claims Advocates comprising of a proficient and focused team with the knowledge and experience to comply with all of the VA’s complex filing requirements. Working as an extension of your team, we help providers maximize reimbursement, reduce denials, and lower bad debt reserves on VA claims.

Contact us to learn how our specialized complex coverage expertise and personalized advocacy approach helps patients secure the coverage they need while delivering the financial reimbursements providers deserve.